One thing that has largely been put on hold due to the coronavirus pandemic—which has led to 8.06 million confirmed cases worldwide—is vacations. While all states have reopened their economies in some capacity, many individuals are still wary of contracting the virus and are staying home when possible and taking precautionary measures in public. But where does that leave the second-home markets to which luxury buyers typically flock for leisure?

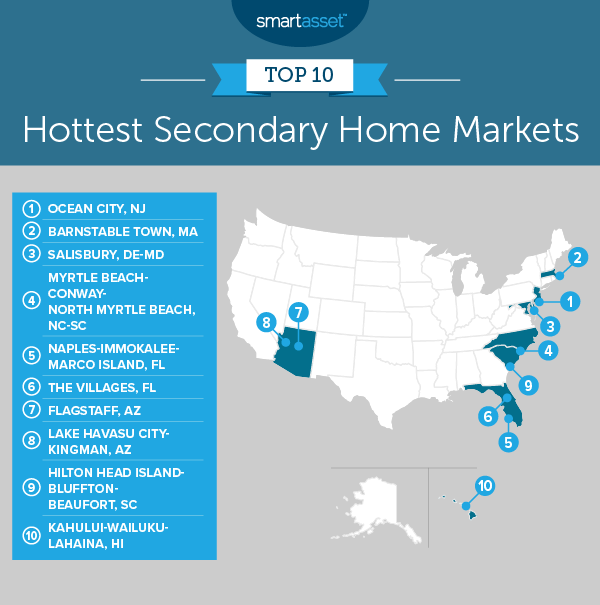

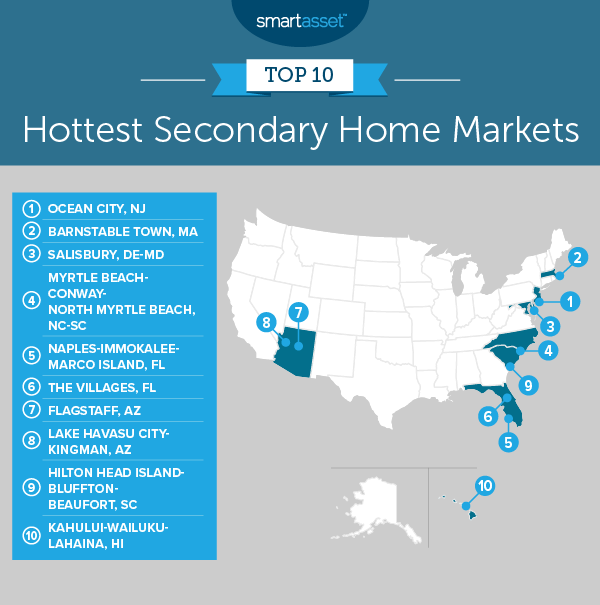

According to a report from SmartAsset, released earlier this year, the Top Five Hottest Secondary Markets in the U.S. are Ocean City, N.J.; Barnstable, Mass.; Salisbury, Del-Md.; Myrtle Beach-Conway-North Myrtle Beach, N.C.-S.C.; and Naples-Immokalee-Marco Island, Fla.

Here’s the full Top 10 list from Smart Asset:

Several brokers say some of these second-home markets have lagged behind amidst the pandemic and others are holding strong. Overall, sales have slowed. One of the biggest challenges right now is not lack of interest—in fact, buyers are still active. In many markets across the U.S., however, there is a significant inventory shortage.

“All of our Jersey Shore markets are grouped within 30 miles, thus there are many similarities in market conditions,” says Stephen Booth, SVP, regional manager, and broker of record at Berkshire Hathaway HomeServices Fox & Roach REALTORS® – The Trident Group in New Jersey. “All are experiencing a lack of active listing inventory and increased demand from buyers.”

But due to virus concerns, buyer interest does not always translate to in-person buyer traffic, introducing added challenges. For example, Jim McCallum, broker associate at Berkshire Hathaway HomeServices Home Team Realty in Florida, says the demand is there, but many sales are online, making it “harder for some homes where people need to physically see the home to appreciate it.”

In Hawaii, says Anton Steenman, CEO, Elite Pacific Properties, all islands have been affected, primarily by the strict lockdown in April, which made it difficult for buyers to visit the islands.

“In general, the sales activity was slow, although single-family homes fared better than condos, which are down by an additional 16 percent.”

Daniel Collins, co-owner of Realty ONE Group Mountain Dessert says inventory in his most resilient second-home markets, Flagstaff and Lake Havasu City, is “still really low.” However, these niche markets represent an added attraction for today’s second-home buyers: an outdoor reprieve from the stay-at-home slog.

“These markets have amazing outdoor lifestyles (mountains and lakes), which is what I think people want—to get out and enjoy the outdoors and some sunshine,” says Collins.

Julie Toon Timms, broker-in-charge and owner of Hilton Head Island Real Estate Brokers in South Carolina, says the second-home markets that are proving the most resilient these days are those with an abundance of amenities and the capacity to generate rental income.

“Hilton Head Island is a beautiful place to live and people that I am working with say that they want to be away from large cities and down where they can enjoy the natural beauty that surrounds them,” says Timms. “Many of our second-home purchasers would have rather come to their homes (as many of our second-home owners did) and ride out the pandemic, than being stuck in very confined spaces with strict limitations on activities.”

Steenman says his agents report that buyer priorities have “swiftly changed.”

“Previously, there had been a high demand for properties with smaller footprints. Now, discussions center around finding a larger living room and kitchen space, having a dedicated home office as well as having recreational and outdoor spaces for activities,” says Steenman.

Another trend? Purchasers want more space away from others so they can still enjoy their secondary properties without having to worry about contracting the virus.

According to the recently-released Luxury Home Market report, released by Elite Pacific Properties in partnership with the Institute for Luxury Home Marketing, many of the Hawaii resort markets that attract second-home buyers are low density, with spacious lots, which could bode well for a post-COVID rebound.

Steenman says Hawaii’s drop in condo sales, especially in the luxury market, reflects this change in purchasing trends. Due to COVID-19, affluent buyers are now looking to invest in stand-alone properties “to ensure a safe haven for their families,” he says.

In addition, the less hassle, the better, brokers say. According to Timms, buyers today are “looking for turnkey properties that are well priced and updated.”

For many, this also means staying close to “home,” meaning avoiding international travel. Booth says most interest is in the beach communities of Ventnor, Margate and Longport (where YoY sales prices have increased 20 percent), and Ocean City (where sales prices increased almost 17 percent YoY). He has found that buyers in these markets mostly have “long-time ties to the shore area.”

“Many vacationed here as children with their parents and grandparents and return as adults with their own children, offering them the same experience to create their own Jersey Shore memories,” says Booth. “This generational experience is so strong that, many times, generation after generation return to purchase only on the same resort island and often the same neighborhood.”

McCallum can confirm this on the reverse—those who are selling their second-home residences in the U.S. are typically from Europe or Canada because they are unsure of when they will be able to return.

Despite the challenges, brokerages in these markets have leveraged all the technology at their disposal to overcome obstacles related to in-person transactions. In Arizona, for example, Collins says Realty ONE Group doubled down on agent training to ensure everyone was up to date on the latest technology.

“We will definitely keep doing more Zoom and virtual classes and meetings while slowly getting back to face-to-face gatherings,” says Collins. “I love that photography, video and virtual tours have become more commonplace, and I hope it continues as that’s our job as real estate professionals: to continue to up our game and adopt new technologies to better serve our clients.”

Booth reports a focus on remote working as well, stating “Many of our offices remain closed to the public so virtual property showings, virtual open houses, virtual office meetings and virtual training sessions have become the norm.”

Practitioners are optimistic that sales will pick back up as the pandemic subsides. In Florida, McCallum says The Villages market is currently “very strong on homes in the mid-ranges (265K-300K).” In addition, he says, updated, higher-priced homes with pools or on golf courses have also been “snapped up quickly.” He emphasizes that Florida is still the place to be long term, with home values rising 5-9 percent.”

Collins says that Sedona experienced a slow-down, primarily due to high price points with already-low inventory. However, he expects the Arizona second-home markets to bounce back very strong in July through September.

Also, a shift in stock market activity could help boost recovery in these second-home markets, according to Steenman.

“Although the stock market continues to show significant volatility, we have entered a sideways moving phase,” says Steenman. “This should be positive for luxury markets in Hawaii when it becomes easier for buyers to travel to the islands. The amount of interest, combined with persistently low inventory, should create promising growth opportunities as we come out of the COVID-19 lockdown.”

If the markets can return to a pre-COVID environment, the outlooks are very optimistic. According to the National Association of REALTORS® (NAR), the median sales price in vacation home counties increased 36 percent from 2013 to 2018, compared to 31 percent for all existing and new homes sold in that same period. NAR accounts that growth to a build-up of financial wealth, as well as low mortgage interest rates.

In September, Luxury Portfolio International® (LPI), the luxury marketing division of Leading Real Estate Companies of the World®—released a global report: “The Allure of the Second Home: Why Affluent Buyers Are Displaying Confidence in Resort Markets.” The report stated that in the last four years, personal wealth globally has grown by 15 percent and the number of high-net-worth individuals has increased by 25 percent.

The key to purchasing a second-home property in today’s market, according to brokers, is not waiting.

“I haven’t seen a better time to invest in the second-home market in a long time. Interest rates are incredibly low, the selection of property is good but shrinking as more and more people want to be here,” says Timms. “Prices are rising so those who wait too long may be priced out of the market.”

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to