2022 HOUSING MARKET PREDICTIONS

As 2021 draws to a close, you’re probably already getting questions from clients about what experts are projecting for the 2022 market.

The past two years have been full of exciting and record-breaking moments. It’s also seen its fair share of buyer fatigue, hesitancy and confusion.

Here’s what industry experts are saying about what they anticipate for the 2022 housing market.

Home Prices

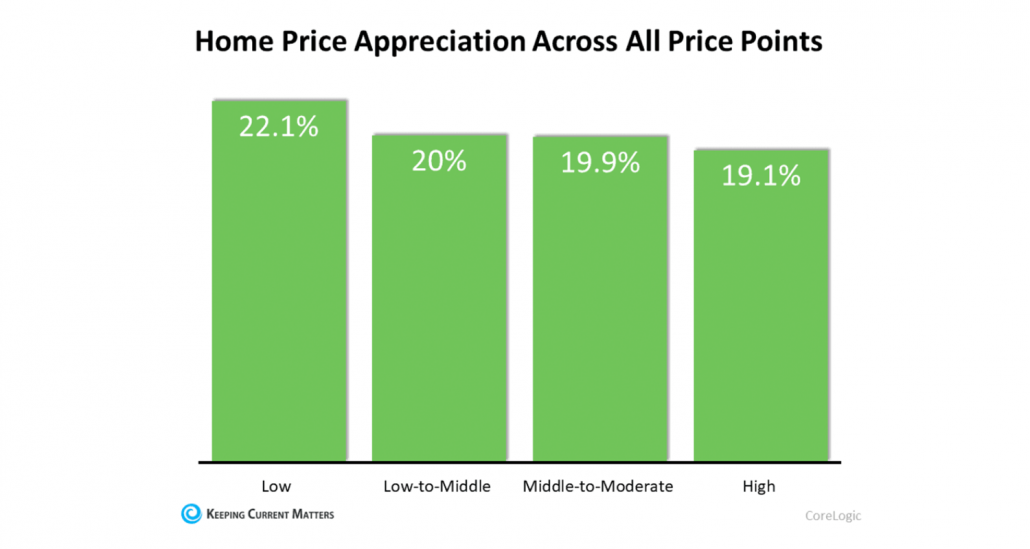

In the past 12 months, home price appreciation has been the topic of many headlines, and not in a good way. Speculation that we’re in another housing bubble has kept many buyers and sellers hesitant that we’re headed for another crash.

So, what does the future hold for home prices?

It’s important to remember that the 2021 market was anything but normal, and that escalating home values were a direct result of record-low inventory.

However, experts project that the inventory situation should improve in the coming year, stabilizing price appreciation across the nation.

But will home prices depreciate in 2022? Over 100 industry experts don’t think so. Instead, they are projecting a more modest appreciation of 5.82% in the next 12 months compared to the 11.74% rise seen on average in 2021.

Mortgage Rates

In case you didn’t know, the past year saw the lowest mortgage rates in the history of real estate.

So, if you have clients who are waiting for those rates to come back down or go down more, they may be waiting a very long time.

What’s important to remind your clients is that while homes right now may be less affordable than they were a year ago, they’re still extremely affordable.

If we look at the 30-year mortgage rate chronicled by Freddie Mac, we can see the average rates by decade:

- 1970s: 8.86%

- 1980s: 12.7%

- 1990s: 8.12%

- 2000s: 6.29%

- 2010s: 4.09%

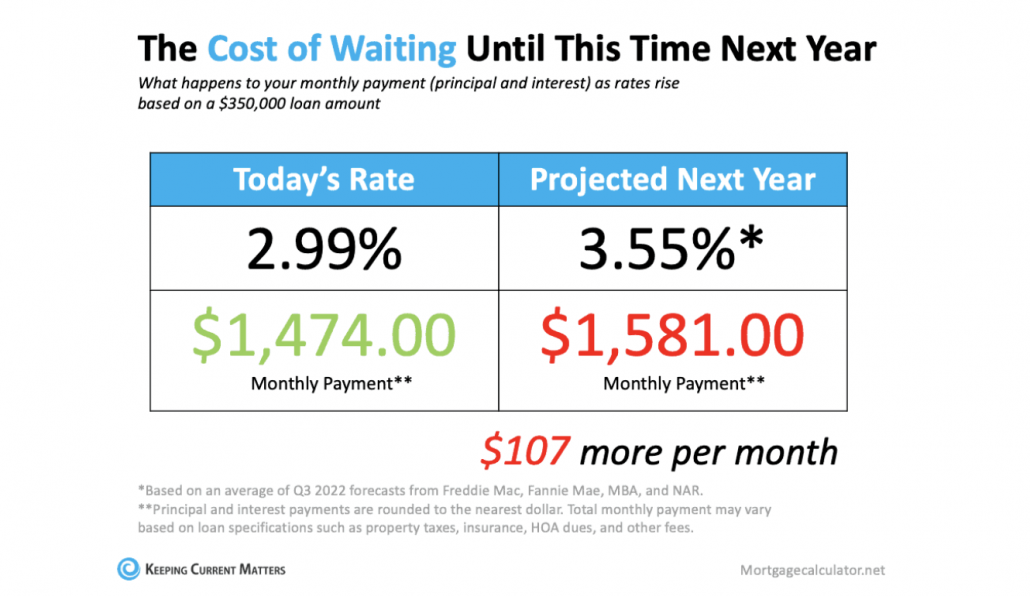

While experts don’t project that mortgage rates will rise a huge amount, any increase would mean an increase in monthly mortgage payments.

A couple decimal points may not seem like a lot to most people, but it could make or break someone’s budget.

If you have buyers that are playing the waiting game, the best advice you can give to them is that a rise in mortgage rates coupled with continued home price appreciation only means one thing: paying more for the same house they’d buy now.

Housing Inventory

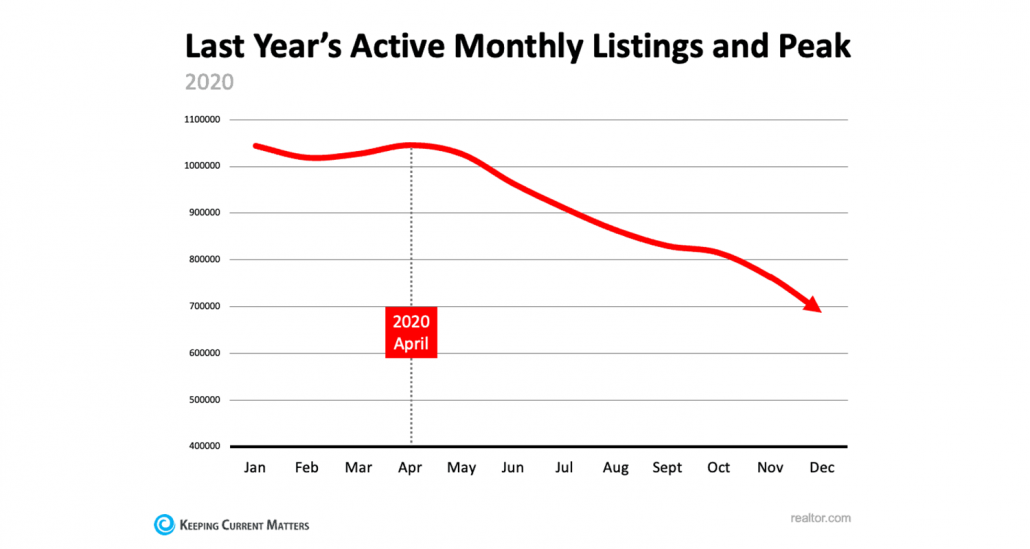

Inventory has been, without a doubt, the biggest player in the anything but ordinary real estate market we’ve experienced in the last two years.

With buyer fatigue running high, you’re probably getting asked, “Will housing inventory increase in 2022?”

The good news is, there are many factors that lead industry experts to anticipate a rise in homes for sale.

Here’s why:

- Homeowners may be more confident putting their homes on the market as COVID numbers continue to drop and more people become vaccinated.

- Many of the obstacles halting or slowing new construction start to fade and those homes come on the market, adding new inventory and meeting the needs of population growth.

- As forbearance comes to a close, experts predict a wave of new homes coming to the market. However, they don’t anticipate the majority of these to be foreclosures. Instead, because of built-up equity, homeowners in this position will have the opportunity to sell instead.

While more inventory may take a bit of the edge off of today’s competitive market, it’s important to remind your clients that it doesn’t mean prices will fall or homes will become more affordable. There will just be more available to choose from.

Bottom Line

If we’ve learned anything in the past couple of years, it’s that while we can project the future, we can’t predict it.

While industry experts don’t expect the 2022 housing market to be as crazy as 2020 or 2021, it’s important to stay on top of the latest insights to make sure you’re always giving your clients the most up-to-date information.

And if you want an easy way to do it, try signing up for the daily blog by KCM so you get the top real estate news and data delivered to your inbox every weekday.

There’s never been an easier way to keep you and your clients informed on what’s happening in the housing market. Sign up today.

Jesse Williams is RISMedia’s associate online editor. Email him your real estate news ideas to

Jesse Williams is RISMedia’s associate online editor. Email him your real estate news ideas to